In the fast-paced world of trading, the difference between success and failure often hinges on the ability to analyze past performance effectively. For traders of all experience levels, maintaining a detailed trading journal is essential.

But why settle for a manual approach when you can harness the power of automation? Creating an automated trading journal not only streamlines the process but also enhances the depth and accuracy of your insights. Imagine a dynamic tool that continuously tracks your trades, assesses your strategies, and provides you with real-time feedback—transforming the way you approach the market.

In this article, we’ll explore the steps you need to take to set up an automated trading journal that doesn’t just record actions but propels you toward informed decision-making and improved performance. So, grab your systems and tools; let’s dive into the world of automated journaling!

Understanding the Importance of a Trading Journal

A trading journal is not merely a ledger of transactions; it serves as a crucial tool for both reflective practice and strategic improvement. By meticulously documenting each trade—detailing the rationale behind decisions, market conditions at entry and exit points, and emotional responses—traders open the door to profound insights that can sharpen their strategies over time.

Each entry becomes a snapshot of a moment in the fast-paced world of trading, allowing one to dissect both the successes and missteps with a nuanced perspective. This layered analysis fosters a deeper understanding of personal patterns, risk tolerance, and the psychological facets of trading.

For those using an auto trading platform, maintaining a trading journal becomes just as essential. Although automated systems handle the execution of trades, documenting the performance of strategies and adjusting parameters based on market conditions remains a key component of success.

The journal helps traders track which strategies yield the best results and identify potential improvements or risks. Ultimately, a well-maintained journal transforms raw data into a narrative that can guide traders—whether trading manually or through automated platforms—toward more informed choices, helping them evolve in an ever-changing market landscape.

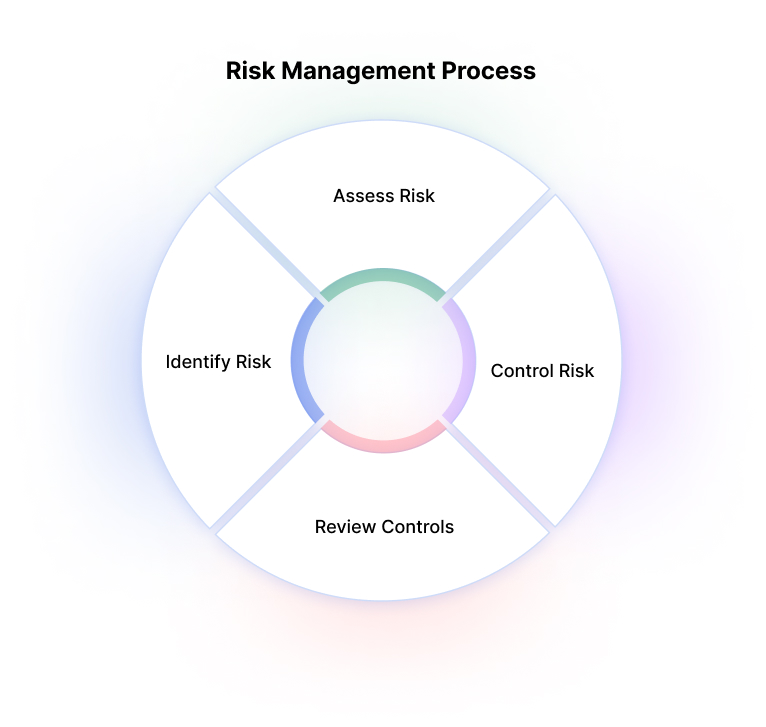

Incorporating Risk Management Strategies

Incorporating effective risk management strategies into your automated trading journal is essential for safeguarding your investments while optimizing performance. Begin by defining your risk tolerance: how much capital are you willing to risk on each trade? This foundational step shapes your approach to position sizing and leverage.

Furthermore, consider implementing stop-loss orders to minimize potential losses on individual trades—these act as safety nets, preventing emotionally driven decisions in the heat of the moment. Tracking your win-loss ratio is vital; it provides insight into your trading patterns and areas for improvement.

Don’t forget to analyze the overall market conditions as well—external factors can significantly influence your strategys effectiveness. By meticulously documenting your risk management strategies alongside performance metrics in your journal, you create a comprehensive roadmap that not only guides your trading decisions but also fortifies your path to consistent profitability.

The Future of Trading Journals

As we look ahead to the evolving landscape of trading journals, it’s clear that the integration of advanced technologies will redefine how traders analyze and optimize their performance. Imagine a world where artificial intelligence not only tracks your trades but also intelligently learns from your patterns, offering new insights tailored to your style.

Automation will become increasingly sophisticated, allowing traders to focus on strategy rather than tedious record-keeping. Visual data representations can emerge, transforming raw numbers into compelling narratives that guide decision-making.

Furthermore, the rise of collaborative platforms may foster community-driven learning, where traders share their experiences and findings in real-time, enhancing collective wisdom. The trading journal of the future will be more than a personal log; it will be an interactive, intelligent companion guiding traders toward their goals with unparalleled clarity and efficiency.

As we embrace this transformation, the potential for growth and innovation in trading strategies is limitless, promising a new era for traders willing to adapt and thrive.

Conclusion

In conclusion, establishing an automated trading journal is a vital step for any trader looking to enhance their performance and decision-making processes. By leveraging advanced technologies and integrating your journaling efforts with an auto trading platform, you can systematically track your trades, analyze results, and identify patterns that could lead to improved strategies.

The insights gained from an automated journal not only help in refining your trading approach but also instill discipline and accountability in your trading routine. Ultimately, taking the time to create and maintain an automated trading journal can significantly bolster your success in the ever-evolving world of trading.