In the fast-paced world of trading, where the stakes can soar to dizzying heights, the journey from novice to seasoned trader can often feel like navigating a treacherous maze. Many aspiring traders jump headfirst into the live markets, driven by the allure of instant profits and the thrill of the chase.

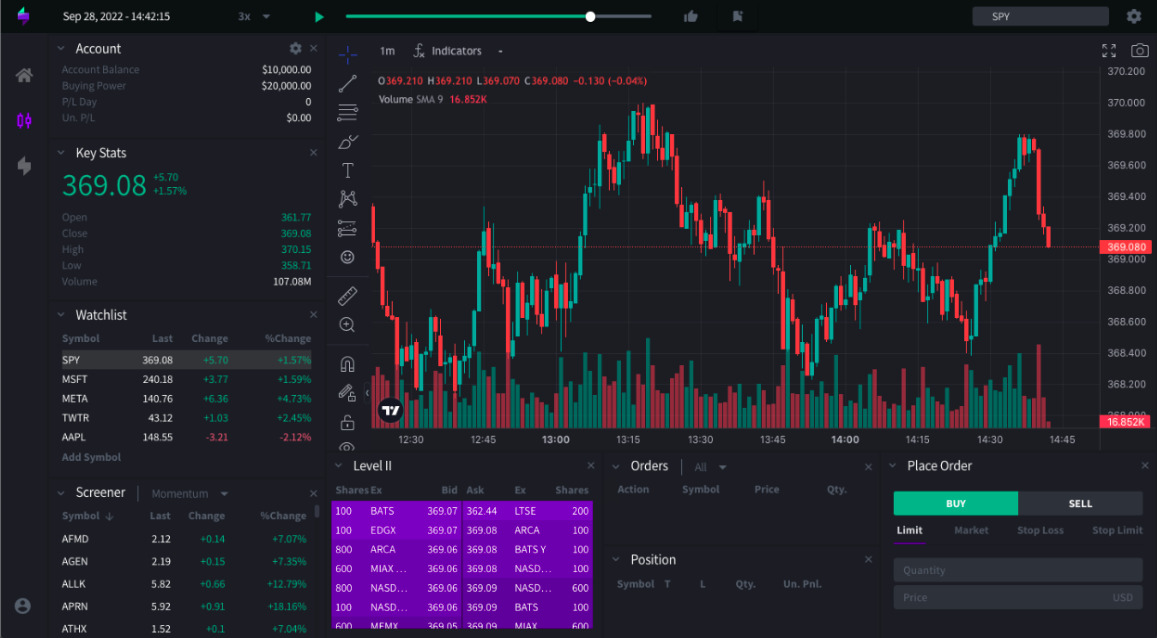

However, this impulsive leap can lead to costly missteps and a whirlwind of chaos. Enter the trading simulator—an invaluable tool that allows traders to immerse themselves in the markets complexities without risking real capital.

By simulating real-world scenarios, traders can develop their strategies, sharpen their skills, and build the confidence needed to make informed decisions. This crucial preparatory step not only fosters a deeper understanding of market dynamics but also empowers traders to approach the live arena with clarity and resilience.

In a landscape where knowledge is power, the time spent mastering the simulator may well be the most transformative investment a trader can make before setting out on their live trading journey.

Benefits of Using a Trading Simulator

Using a trading simulator offers a multitude of benefits that can significantly enhance a trader\’s skill set before they venture into the unpredictable waters of live trading. Firstly, it allows for a risk-free environment where one can experiment with diverse strategies and tools without the looming threat of financial loss.

Imagine the power of honing your technical analysis skills while exploring different market conditions! The bar replay free feature further enriches this experience by letting you revisit and analyze past market movements, providing deeper insights into the effectiveness of your strategies. The flexibility of simulating trades at any time, coupled with immediate feedback on decisions made, fosters a robust learning experience that is hard to replicate elsewhere.

Furthermore, it cultivates discipline, as traders can practice setting limits, managing emotions, and refining their decision-making processes in a way that mirrors real-time scenarios. Ultimately, a trading simulator serves not just as a practice ground but as an essential stepping stone that builds confidence and competence, paving the way for a more successful transition to live trading.

Analyzing and Learning from Mistakes

Analyzing and learning from mistakes is an integral part of a traders evolution, especially when using a trading simulator. Imagine you execute a series of trades—some yield profits while others bleed red.

In that simulated environment, you possess the unique opportunity to dissect each decision. What emotions clouded your judgment? Were there external factors you overlooked? With each error lies a lesson, waiting patiently to be uncovered.

By revisiting your trades—both the triumphs and failures—you can extract invaluable insights that refine your strategy. This process isn’t merely about tallying wins and losses; its about harnessing those moments of miscalculation to fortify your trading acumen for the real world.

Embrace the discomfort of error as a teacher; it is through this rigorous reflection that you transform setbacks into stepping stones towards mastery.

Tips for Maximizing Your Simulator Experience

To truly maximize your time on a trading simulator, immerse yourself in a routine that mirrors real-world trading conditions as closely as possible. Start by setting specific goals for each session: are you honing your technical analysis skills, testing a new strategy, or simply getting comfortable with the trading interface? Keep a trading journal throughout your practice to document your decisions, emotional responses, and areas for improvement; this reflective practice will deepen your learning process.

Dont shy away from experimenting with different asset classes and market conditions—variety will enhance your adaptability as a trader. Moreover, make use of simulated news events to understand how external factors can impact your strategy; this helps cultivate your instinct for reading the market.

Finally, seek feedback from fellow aspiring traders or mentors; collaboration can offer unexpected insights that refine your skills further.

Conclusion

In conclusion, spending time on a trading simulator before entering the live market is not just a beneficial practice; its an essential step for any trader aspiring to succeed. The risk-free environment allows traders to develop and refine their strategies, understand market dynamics, and build confidence without the pressure of real financial stakes.

Features like the bar replay free functionality enable traders to revisit past market conditions, providing invaluable insights and the opportunity to learn from historical trends. By investing time in a trading simulator, traders not only enhance their skills but also position themselves for greater success when they eventually transition to live trading.

Ultimately, this groundwork lays the foundation for a disciplined and informed approach to the complexities of the financial markets.